COURSE DESCRIPTION

MACRO ECONOMICS | ONLINE TUITION CLASSES FOR 12, provides a wide range of concepts and advanced information regarding the subject which includes all the questions provided in the CBSE Class 11 Economics Syllabus.

Economics concentrates on how governments, businesses, households, societies, and individuals make choices about when, where, and how to use their natural resources at its best. It is a study that deals with many abstract and ideal blueprints to study the action and foretell how institutions will acknowledge to given changes in fiscal policies and market conditions among other factors.

Economics for class 12 is an enhanced level of class 11. In class 11th book Micro Economics, we had studied the basic fundamental aspects of the subject. And, in class 12 it is a progressed degree of concepts.

Macro Economics deals with the economic behavior of all the individuals as an aggregate in the economy. In this, we will study about Circular flow of the economy, Aggregate demand/supply, National income, Domestic income, Government Budget, Money and supply, Different Market forms, etc.

OBJECTIVES:

- Understanding of some basic economic concepts and development of economic situation of a country, which the learners can apply in their day-to-day life as citizens, workers, and consumers.

- Realization of learners’ role in nation-building and sensitivity to the economic issues that the nation is facing today.

- Equipment with basic tools of economics and statistics to analyze economic issues. This is pertinent for even those who may not pursue this course beyond the senior secondary stage.

- Development of understanding that there can be more than one view on any economic issue and necessary skills to argue logically with reasoning.

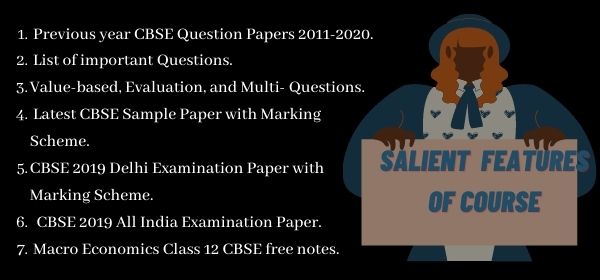

SALIENT FEATURES OF COURSE:

- Each Topic has been written and explained in accordance with the latest guideline issued by CBSE.

- The Concepts have been systematically explained through the use of Diagrams, tables, and examples.

- HOTS Questions with answers have been given at the end of each chapter to enhance the student’s understanding, analytical ability, and interpretation.

- A Quiz of Multiple Choices Questions (MCQ) with answers has been given at the end of Lecture.

- Questions of NCERT TEXTBOOK also discussed with explanations.

- VALUE-BASED Questions with answers have been given in the revision section.

- Practical Problems have been a weightage of 20 to 30 marks in the board examination. To have a Complete edge, a large number of comprehensive solved and unsolved practical problems have been discussed in our lectures.

- Power Booster Section has been provided for the knowledge enrichment of the students.

- This course consist also revision section in which we discuss:

DETAILED SYLLABUS: INTRODUCTORY MACROECONOMICS (New Syllabus in 2022-2023)

CLASS – XII (2022-23) Theory: 80 Marks Duration:3 Hours Project: 20 Marks

| Units | Marks | Periods | |

| Part A | Introductory Macroeconomics | ||

| National Income and Related Aggregates | 10 | 30 | |

| Money and Banking | 6 | 15 | |

| Determination of Income and Employment | 12 | 30 | |

| Government Budget and the Economy | 6 | 17 | |

| Balance of Payments | 6 | 18 | |

| 40 | 110 | ||

| Part B | Indian Economic Development | ||

| Development Experience (1947-90) and Economic Reforms since 1991 | 12 | 28 | |

| Current Challenges facing Indian Economy | 20 | 50 | |

| Development Experience of India – A Comparison with Neighbors | 08 | 12 | |

| Theory Paper (40+40 = 80 Marks) | 40 | 90 | |

| Part C | Project Work | 20 | 20 |

Part A: Introductory Macroeconomics

Unit 1: National Income and Related Aggregates – 30 Periods

What is Macroeconomics?

Basic concepts in macroeconomics: consumption goods, capital goods, final goods, intermediate goods; stocks and flows; gross investment and depreciation.

Circular flow of income (two sector model); Methods of calculating National Income – Value Added or Product method, Expenditure method, Income method.

Aggregates related to National Income:

Gross National Product (GNP), Net National Product (NNP), Gross Domestic Product (GDP) and Net Domestic Product (NDP) – at market price, at factor cost; Real and Nominal GDP.

GDP and Welfare

Unit 2: Money and Banking – 15 Periods

Money – meaning and functions, supply of money – Currency held by the public and net demand deposits held by commercial banks.

Money creation by the commercial banking system.

Central bank and its functions (example of the Reserve Bank of India): Bank of issue, Govt. Bank, Banker’s Bank, Control of Credit through Bank Rate, CRR, SLR, Repo Rate and Reverse Repo Rate, Open Market Operations, Margin requirement.

Unit 3: Determination of Income and Employment – 30 Periods

Aggregate demand and its components.

Propensity to consume and propensity to save (average and marginal).

Short-run equilibrium output; investment multiplier and its mechanism.

Meaning of full employment and involuntary unemployment.

Problems of excess demand and deficient demand; measures to correct them –

changes in government spending, taxes and money supply.

Unit 4: Government Budget and the Economy – 17 Periods

Government budget – meaning, objectives and components.

Classification of receipts – revenue receipts and capital receipts;

Classification of expenditure – revenue expenditure and capital expenditure.

Balanced, Surplus and Deficit Budget – measures of government deficit.

Unit 5: Balance of Payments – 18 Periods

Balance of payments account – meaning and components;

Balance of payments – Surplus and Deficit.

Foreign exchange rate – Meaning of fixed and flexible rates and managed floating.

Determination of exchange rate in a free market, Merits and demerits of flexible and

fixed exchange rate.

Managed Floating exchange rate system

For Demo/Start tuition classes with NCERT JUNCTION: Download this Registration Form, Fill & send WhatsApp: 9540177026Or E-mail: ncertjunction@gmail.com Or Call: 9540177026 for any assistance. Thanks.

MACRO ECONOMICS | ONLINE TUITION CLASSES FOR 12, Call/WhatsApp: 9540177026

NCERT 12th Macro Economics Textbook: Free Download in English

NCERT 12th Indian Economic Development CBSE book: Free Download in English

NCERT 12th Macro Economics Textbook: Free Download in Hindi

NCERT 12th Indian Economic Development CBSE book: Free Download in Hindi

Best reference book for Economics class 12th / CBSE and UP Board 2020-2021 session

CBSE 12th Economics Question Paper 2020: Free Download

Note: Join Coaching Classes: Economics For Class 12th in Greater Noida (Limited Offer to first 5 students only of every new batch)

Best Tuition Classes For Economics, Best Economics Coaching For Class 12, Best Coaching for Economics Near Me, Commerce Classes Greater Noida

——————————————————————————————

⇒⇒⇒⇒⇒ Follow us: ⇒⇒⇒⇒⇒

♥ Facebook: – https://www.facebook.com/ncertjunction/

♥ Skype: – https://join.skype.com/Y0n7PswqY6Q7

♥ Twitter: – https://twitter.com/Ncertj

♥ Linkedin: – https://www.linkedin.com/in/ncert-junction/

♥ Telegram: – https://t.me/NcertJunction

♥ Pinterest: – https://in.pinterest.com/junction0696/boards/

♥ Website: – http://ncertjunction.com

♥ Instagram: – https://www.instagram.com/ncertjunction/

♥ Youtube: – https://www.youtube.com/channel/UCzL2Gfk8bnHmkCe358gcAQg?view_as=subscriber

♥ WhatsApp पर +91 95401 77026 से चैट करें : https://api.whatsapp.com/send?phone=919540177026&text=I%27m%20interested%20in%20your%20course%20for:%20